Offer Summary

+ 5 unit workshop/storage complex in the rapidly growing area of Frankton in Hamilton.

+ Currently leased to six separate tenants on mixed lease terms.

+ Units provide for potential rental growth and are always in demand.

+ Freehold corner site on 1,528 m2 of land with a total floor area of 651 m2.

+ Positioned close to State Highways 1 and 23 making it the perfect location for mobile tradespeople to centralise their stores.

+ Minimum investment is $50,000

Offers will be restricted to “Wholesale Investors” under clauses 3(2) and 3(3) of Schedule 1 to the Financial Markets Conduct Act 2013 (or to any other person to whom an exclusion applies under Schedule 1 of that Act). Preliminary indications of interest are being sought at this stage and no indication of interest will involve an obligation or a commitment to participate in the Offer.

Hamilton

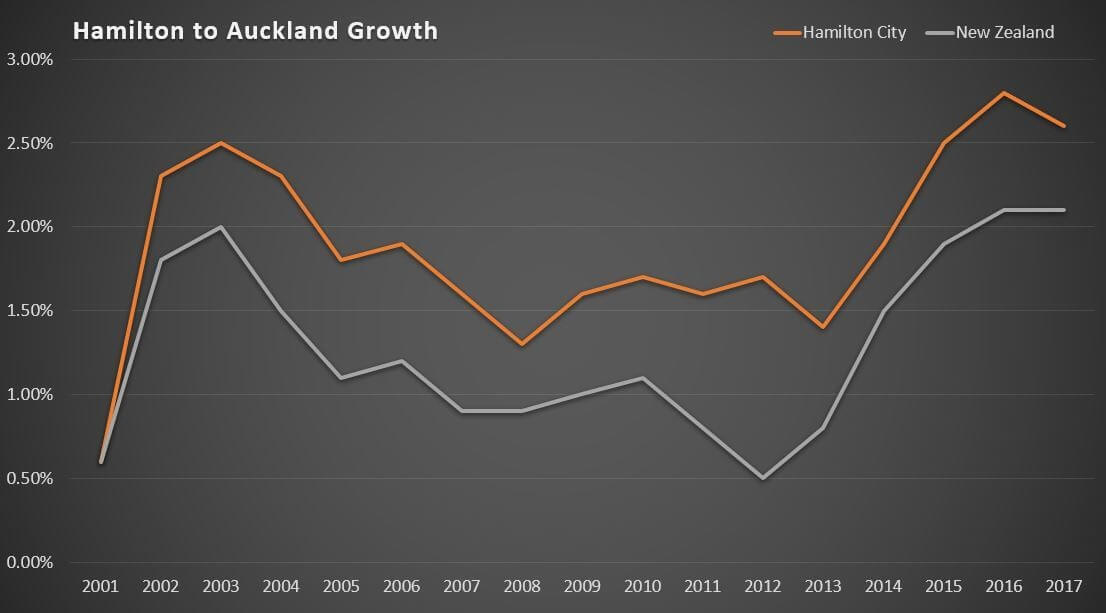

Hamilton’s population is growing more than 30% faster than the New Zealand average, in part due to overflow from Auckland. As Auckland becomes more unaffordable for first home buyers it makes locations like Hamilton more appealing with its reasonable commute time and more affordable housing. Population data released in October 2019 by Stats NZ, shows the population grew 2.2%, against a national average of 1.6%.

The area has two inland Ports (Horotiu and Tainui) and the city is within a two hours’ drive of two of the country's main seaports (Auckland and Tauranga).

Hamilton is located in one of the richest agricultural areas in the world and acts as a major service centre for the Waikato region. Hamilton’s growth underpins strong regional growth – the Waikato (2.1%) was one of five regions to grow at a greater rate than the NZ average.

Risks

Investments in syndicated commercial and industrial property does carry risk. Prospective investors must determine whether the investment is appropriate having regard to their own investment objectives and financial situation. Investors are encouraged to seek independent financial, tax and legal advice on these matters.

The Offeror and General Partner considers that the most significant risk factors that could affect the value of a Limited Partnership interest are:

+ Loss of rental income: A default by any tenant in paying rent and outgoings may affect forecast returns.

+ Re-leasing: Costs may be incurred in any future re-leasing of the property and failure to re-lease will likely affect its value.

+ Interest rate and bank risk: Interest rate movements are unable to be accurately predicted and an increase in interest rates may affect returns and bank covenant compliance.

+ Capital expenditure risk: Capital expenditure for the property may be more than budgeted.

No warranty or representation is made in respect of whether the revenue, expenses, or any capital appreciation in the future will be achieved. Actual results are likely to be different to the forecasts since anticipated events frequently do not occur as expected and the variation may be significant. Accordingly, Erskine + Owen, its shareholders, directors, employees, advisors or agents nor any other person can provide any assurance with respect to such information.