The fund aims to acquire commercial or residential properties with value-add potential.

Investment Summary:

+ Target average total return of 20%+* p.a.

+ Lifetime of the fund is 10 years with a 3-year right of extension

+ The fund will invest across a variety of growth opportunities with varying risk profiles

+ $100,000 minimum investment open to Wholesale Investors only

+ Offer closes upon full subscription

The Growth Fund targets long-term returns and will not provide monthly income. It will focus on acquiring properties, whether land, residential or commercial, with strong growth potential.

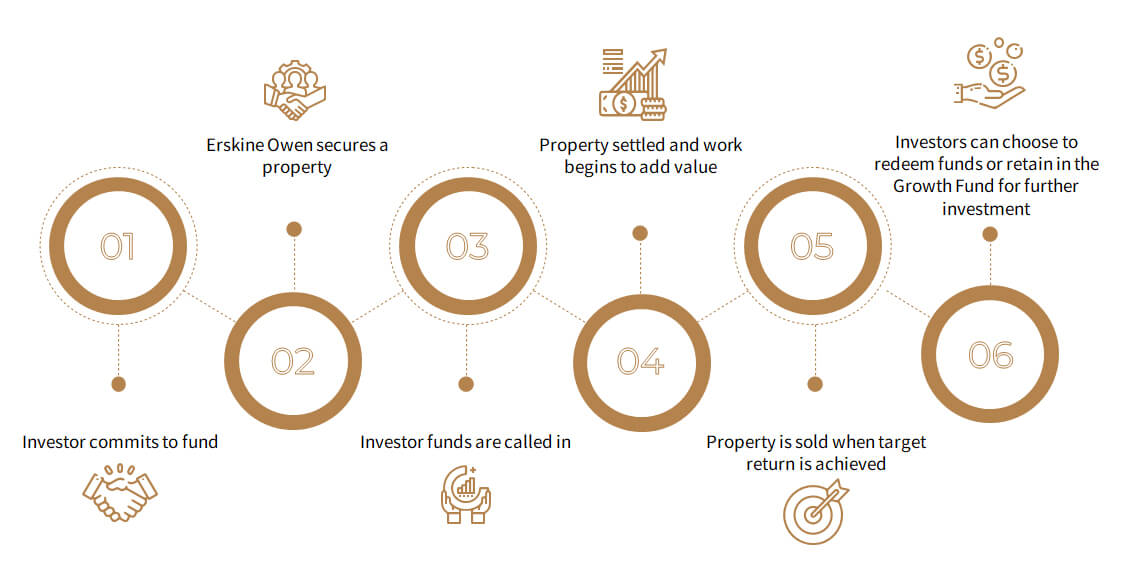

The Process

Our Track Record

Land Re-zone – Queenstown. Over 130% Total Annual Return (Unrealised)

5-hectare land with a luxury lodge in Queenstown

Rationale for purchase:

- Land in Queenstown was (and still is) in very limited supply and therefore it would only be a few years until the property was rezoned from lifestyle rural to residential. This provided the potential for a very favourable value uplift

- Additionally, there was enough income to service some debt and thus increase returns for investors

The Result

- Purchased for $5m

- Settled on November 2018

- Council approved re-zone in June 2022 (now awaiting ministerial sign off)

- March 22 - Registered valuation $19.6m. Valued at $400 s/m

- Neighbouring property, considered inferior, sold for $450 s/m, but valuer could not fully rely on sale as not yet settled

- Therefore, the property is potentially worth $21m

- Average total annual return as at March 2022 - over 130%

Negotiated Lease – Hamilton Lodge, Average Total Return 21% p.a.**

32-room boarding house in Hamilton purchased in 2017

Rationale for purchase:

- Inner city accommodation that provides good yield while holding for capital appreciation and value add opportunities

- 32-rooms

- Purchased in 2017

- Undertook some cosmetic renovations

- Managed by Erskine Owen as boarding house while we searched for a party to lease to

The Result

- Successfully signed lease in June 2022 for $200k representing a return on equity of just under 9% – a significant improvement from a variable return around 5%

**The average is taken over a five year period and reflects both capital gain and annual cash return.

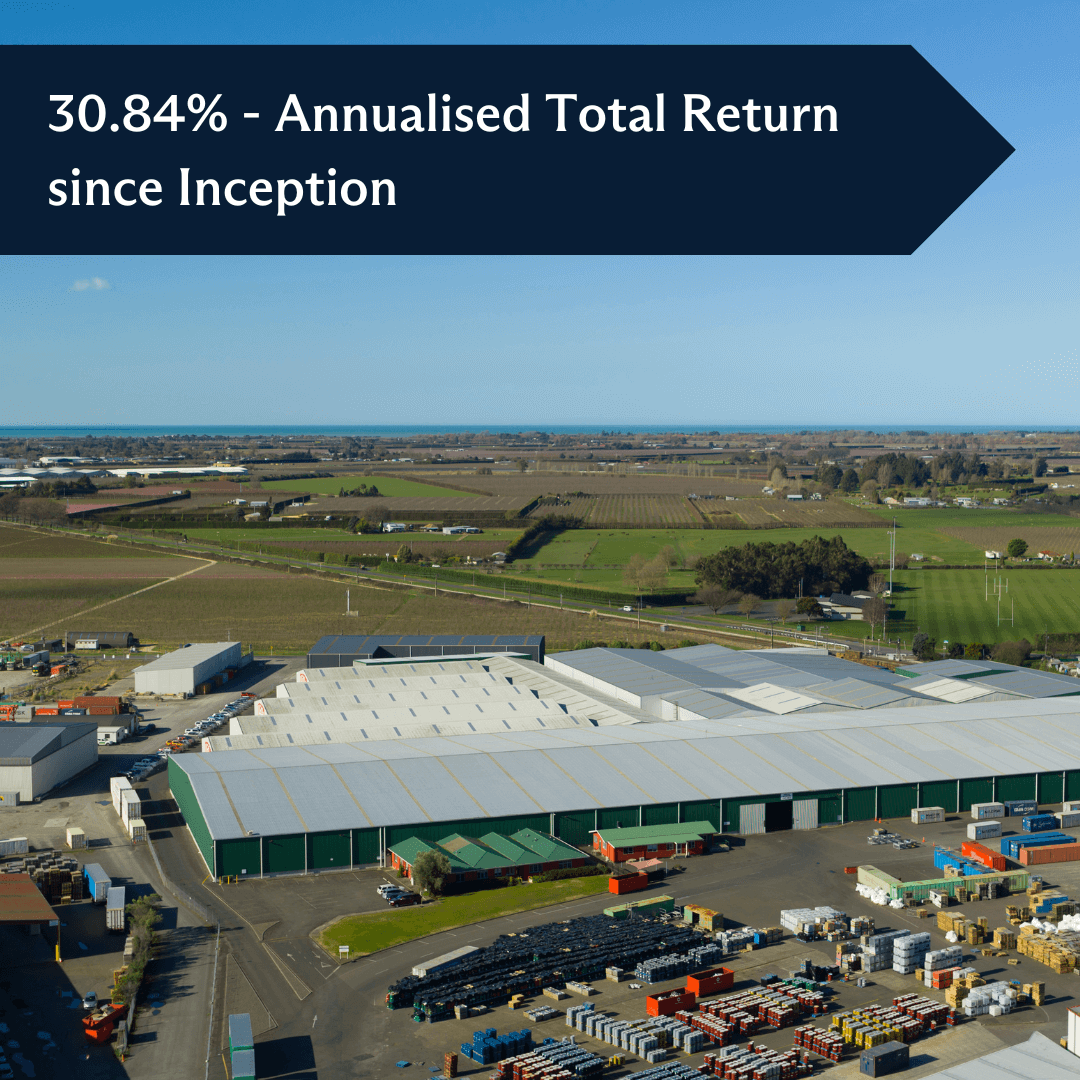

Hastings Distribution Centre Property – Annualised Total Return since Inception – 30.84%

A+ seismic rating warehouse tenanted by Heinz Wattie's in Hastings

Rationale for purchase:

- Tenanted by Heinz Wattie's, an iconic New Zealand brand

- A+ seismic rating warehousing meeting 100% NBS

- Features a rail siding providing direct rail access to Napier Port

- 6.3-hectare site with a gross floor area of 45,351 m²

The Result

- Purchased for $29.1m in 2019, valued at $37m in 2022

- Annualised pre-tax total return since inception 30.84%

*Offers will be restricted to “Wholesale Investors” under clauses 3(2) and 3(3) of Schedule 1 to the Financial Markets Conduct Act 2013 (or to any other person to whom an exclusion applies under Schedule 1 of that Act).

This is not an Investment Memorandum and should not form the basis of and investment decision.

Target average pre-tax annual return over a 10-year period. The target average total return is calculated based on cash distributions and net asset value growth targeted over a 10-year period. No allowance has been made for future selling costs. Details on how the return will be calculated and the risk associated with the investment and return are set out in the Information Memorandum.

For more information about the Erskine Owen Growth Fund, please fill in the form below and we will be in touch.