Survival to Thriving: Riding the Waves of Economic Turbulence The phrase “survive till 25” has become a rallying cry for those feeling overwhelmed by the state of the economy and the higher interest rate environment. While the sentiment may stem from a place of realism, it’s also deeply flawed. If all we do is focus…

Read MoreWe’ve had a bit to say about inflation and interest rates over the past year or so. This is a hot topic and has had a massive impact on many Kiwis. It’s not just those with mortgages, but also the businesses and retailers who bear the brunt of consumers spending less. Our motivation for…

Read MoreHas 8% been your friend or foe? At Erskine Owen we see both sides of the 8% coin. For people with property debt, mortgage rates of 8% +, it has been painful. The rate at which interest rates rose meant the impact was felt quickly and it was hard to make changes rapidly enough to…

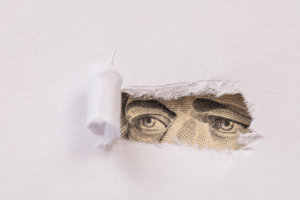

Read MoreThat’s a line from the musical Hamilton which I recently saw…an amazing show. Alexander Hamilton was a founding father of the US – his early life was hard, he fought in wars against the British, he worked incredibly hard for President George Washington, and then he died in a duel defending his honour. Reading his…

Read MoreWho will ever forget Mel Gibson as William Wallace commanding his kilt-wearing kin to ‘hold’ as the English charged them on mighty steeds? Then at the last possible minute, he yells ‘NOW!’ and they lift sharpened poles to massacre the unsuspecting enemy. Perfect timing takes a perfect mix of imagination, hard work, and chutzpah. When…

Read MoreIt was not so long ago that I frequently heard people saying “we are in new era where interest rates will never return to pre-GFC levels”. I listened to a bank economist link interest rate spikes to population explosions, like the post World War 2 baby-boom phenomenon. The argument was that if you went back…

Read MoreNew Zealand is once again proving to be a safe port in a storm – especially during this time of political and economic uncertainty. Expats living in the Asia-Pacific region are at the forefront of those flocking to secure investments back home. The upsurge in interest began in June last year with the rise in…

Read MoreSummary Title: Freehold 718m2 Floor Area: 265m2 Dwelling: Configuration: 2014 built brick exterior with a pressed metal tile roof 4 bedrooms, 2 bathrooms, two separate toilets Garaging: Double with internal access Rent Range: Renovation: Purchase Price: Yield: $680 to $720 per week Presents as being in immaculate condition $1,025,000 3.8% Why this Property? Full…

Read More

Is the NZ Property Party Over?

In the year to September inflation hit 4.9%, the highest in a decade, and mortgage rates have risen rapidly. As a property investor it is natural to be concerned about the impact on property prices and yields…and ask is the property party over? Inflation While the inflation rate has startled some investors, the real question…

Read More