The Reserve Bank (RBNZ) recently proposed a 70% LVR restriction for investors in the Auckland property market. While it was tempting to jump straight out of the gates with a comment, we thought it would be more useful to wait for the RBNZ’s discussion document and provide a deeper analysis of their announcement. In this…

Read MoreOn Thursday 12 June, the Reserve Bank of New Zealand (RBNZ) lifted the Official Cash Rate (OCR) by 25 basis points to 3.25% as anticipated. What will be the impact of this increase? What will be the impact? Floating Mortgage Rate – Floating mortgage rates will increase, with lenders likely to follow ANZ’s lead and…

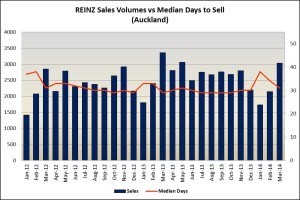

Read MoreIn March, the BNZ-REINZ residential market survey of real estate sales agents reveals an ease in market sentiment, as agents around the country reported most regions to be in equilibrium as buyers began to tentatively re-enter the market after adjusting to last year’s change in lending rules. However, anecdotal evidence from the survey is suggesting…

Read MoreOnly two months since the reserve bank brought in new LVR lending legislation, they have amended their stance. New home builds will now be exempt from the lending restriction, which according to the Registered Master Builders Federation, will ensure the development of up to 5000 homes in the next year. This figure is only an…

Read More

40% deposit requirement, what’s the impact… and what are your options?

Should investors be scared off by the Reserve Bank’s increasingly hands-on approach to the property market? Not necessarily, as there are upsides – it creates a safety valve against potential overheating, and gives rise to some innovative investment vehicles. As investors, we Kiwis are used to a relatively unregulated property market. We’re renowned for favouring…

Read More