I thought I was clever in coming up with this term (Trumpolining) all by myself. However, an internet search revealed it is now in the urban dictionary. Here is one definition: It’s often used to describe the way Trump has bounced between various political positions, made contradictory statements, or “jumped” from one idea to another. …

Read MoreSurvival to Thriving: Riding the Waves of Economic Turbulence The phrase “survive till 25” has become a rallying cry for those feeling overwhelmed by the state of the economy and the higher interest rate environment. While the sentiment may stem from a place of realism, it’s also deeply flawed. If all we do is focus…

Read MoreWe Kiwis have a love affair with property. We love the idea of owning all those wonderful pieces of New Zealand land. We jump in and discover rent arrears, repairs and maintenance, interest rates, etc. For some, it’s too hard, but like relationships, a lot hang in there and reap the benefits. But every now…

Read MoreWe’ve had a bit to say about inflation and interest rates over the past year or so. This is a hot topic and has had a massive impact on many Kiwis. It’s not just those with mortgages, but also the businesses and retailers who bear the brunt of consumers spending less. Our motivation for…

Read MoreHas 8% been your friend or foe? At Erskine Owen we see both sides of the 8% coin. For people with property debt, mortgage rates of 8% +, it has been painful. The rate at which interest rates rose meant the impact was felt quickly and it was hard to make changes rapidly enough to…

Read MoreYou know that feeling – when you’ve been in a hard battle, the fight is still going on, but you basically know you’ve beaten your foe. I’ve had the experience several times over the last few days as I lived vicariously through Olympic athletes. In the rowing, the men’s pair had a stunning race and…

Read MoreThe Inflation Genie is Back in the Bottle… What are we Waiting for? When there is ‘an elephant in the room’ that needs to be addressed, how do you deal with it? Let the air from the beat of your wings waft over people and make them think….i.e. approach with incredible diplomacy? Shoot the…

Read MoreProperty Market Update: “Farewell, we expect you’ll go well son…” Our eldest departed for university a couple of weeks ago. I expect he’ll go well. He’s quite academic, sporty and determined (maternal traits). We gave him a credit card for emergencies which has already come in handy on several occasions – once at the Marlborough…

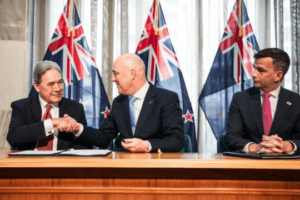

Read MoreThe Three Musketeers (The Property Implications of the Coalition Agreements) Before you chortle at the idea of Luxon, Peters and Seymour galloping in on stallions, dressed in tights and brandishing cutlasses, bear with me….it might not be as fantastical as you think. First let’s refresh ourselves on the fictional story. The Musketeers were formally…

Read MoreThis article is the second in our series on what to do if you find yourself in financial stress, with a particular focus on property ownership. Part A addressed the psychological and emotional stress of dealing with challenging financial situations. If you are looking down the barrel of being short on the next mortgage payment,…

Read More