Let’s go Trumpolining

I thought I was clever in coming up with this term (Trumpolining) all by myself. However, an internet search revealed it is now in the urban dictionary. Here is one definition:

It’s often used to describe the way Trump has bounced between various political positions, made contradictory statements, or “jumped” from one idea to another.

It has also been used to describe situations where someone seems to flip-flop or change direction rapidly.

Are we as a nation becoming Trumpoliners in our investment approach, or are we adopting a sound investment approach? One that knows where it is going but is flexible enough to be able to adjust for the prevailing winds? Time and again research shows that more often than not people preach an investment theory, but emotion wins the day.

New Zealand Investor Confidence: A Case of Trumpolining in the Face of Economic Volatility

Investor confidence in New Zealand over the past few years can best be described as a game of “Trumpolining” – a term that encapsulates the rapid bouncing between highs and lows, much like the unpredictability seen in the political antics of former President Donald Trump. Just as Trump’s political positions and rhetoric seemed to flip-flop at every turn, New Zealand’s investment landscape is showing similar volatility in response to an array of economic indicators, including interest rates, exchange rates, inflation, GDP reports, and unemployment data.

Interest Rates: The Highs and Lows

Interest rates in New Zealand have become one of the most significant factors in shaping investor sentiment. The Reserve Bank of New Zealand (RBNZ) has been on a policy rollercoaster since the pandemic hit, drastically slashing rates to near-zero levels to stimulate the economy. As inflation started to rear its head in 2021 and 2022, however, the RBNZ began a series of aggressive rate hikes to curb rising prices. Investors, much like a bouncy trampoline, reacted to these rate changes, flipping from optimism to concern as the cost of borrowing soared.

When interest rates were low, there was a surge in property investments, stock market enthusiasm, and corporate borrowing. But with rising rates, the investment mood quickly flipped. Property markets cooled, borrowing became more expensive, and equity markets faced increased volatility. This constant tug-of-war between rates that stimulate growth and those that fight inflation has investors hesitating, unsure of the economic environment ahead.

Exchange Rates: A Tug-of-War on the Global Stage

The New Zealand dollar (NZD) has faced its own turbulent journey, swaying with the winds of global economic shifts. As the world’s central banks responded to inflation, the NZD has fluctuated dramatically against other major currencies, notably the US dollar. A weakening currency often leads to rising import costs, triggering inflationary pressures that impact investor decisions.

At times when the NZD strengthens, foreign investors find New Zealand more attractive due to its cheaper assets, increasing demand for local markets. But when the NZD weakens, those same investors may retreat, causing an overall slowdown in investment activity. This “Trumpolining” of exchange rates—bouncing between highs and lows—has added an additional layer of uncertainty for New Zealand investors, complicating investment strategies.

Inflation and Economic Growth: The Ebb and Flow

Inflation in New Zealand has been another major driver of investor sentiment. Over the last few years, New Zealand, like many other nations, has seen inflation surge to levels not witnessed in decades, driven by global supply chain disruptions, energy price spikes, and local cost-of-living increases. For investors, inflation acts as a major concern because it erodes purchasing power, dampens consumer spending, and increases the cost of doing business.

GDP reports and economic growth numbers further fuel this investment flip-flopping. Strong economic growth might encourage optimism, with investors betting on continued prosperity. However, when economic growth slows or contracts, it causes a swift downward reaction in the investment market. Much like the unpredictable nature of Trump’s political strategies, New Zealand’s economic performance has become a source of both enthusiasm and caution in equal measure.

Unemployment: The Final Piece in the Puzzle

Unemployment data has also been a key factor in shaping investor perceptions. Over the last year, New Zealand has enjoyed historically low unemployment rates, a trend that tends to inspire investor confidence, as it signals a healthy, thriving labour market. However, the potential for wage inflation and higher labour costs has caused a cautious response from investors, who are unsure whether this trend is sustainable in the long term.

On the flip side, if unemployment were to rise, it could dampen investor confidence and lead to a pullback in economic activity. Again, the reaction to labour market conditions feels like a bouncing ball, with investors continuously reevaluating their positions based on the latest data.

The Trumpolining Effect

When looking at all these factors in tandem—interest rates, exchange rates, inflation, GDP reports, and unemployment—it’s easy to see the parallel with “Trumpolining.” Just as Trump’s political decisions often seemed erratic, shifting quickly between extremes, New Zealand investor confidence is being pulled in different directions. One moment, investors are riding high on optimism, fuelled by solid economic reports or favourable interest rates; the next, they’re worried about inflationary pressures or a potential slowdown.

In many ways, New Zealand’s economic landscape right now resembles a trampoline: it’s volatile, it’s unpredictable, and investors are finding themselves bouncing back and forth between hope and uncertainty. This unpredictable cycle is challenging for both local and international investors who must remain agile and ready to adjust to the next economic shift.

Conclusion: A Cautiously Optimistic Future?

While New Zealand’s investor confidence may resemble the erratic nature of “Trumpolining,” it’s important to note that such volatility is not unique to this small island nation. Global markets are facing similar challenges, and the ability to adapt to changing economic conditions is becoming the new norm for investors worldwide.

The key takeaway for investors in New Zealand is to approach the market with caution and flexibility. Just as you wouldn’t perform a flip on a trampoline without understanding its unpredictable nature, New Zealand investors should be prepared to pivot quickly in response to the fluctuating economic signals. And much like a skilled trampoline jumper, those who can navigate the highs and lows of the market may just find themselves landing in a favourable position.

In the end, the key to investor confidence in New Zealand lies not in avoiding the “Trumpolining” volatility but in mastering the art of timing and adaptability.

What to Watch for and how to Bounce Accordingly

- OCR. We expect 25 – 50 basis points. We think it will contribute to:

- Consumer and business confidence lifting

- More mortgage approvals

- More property investment buying

We anticipate a steady drop in the OCR which will result in a steady lift in property investment.

- Inflation – a big driver of inflation in the last quarter was an increase in rental prices. What does that tell us? Stock is in short supply. Which is exactly what we expected given houses are not being built at the rate required. So, for investors yields are improving and interest rates are dropping…hmmm.

Regardless, we don’t see inflation being a concern this year. There are other things to worry about…

- Grow, grow, grow. The government has spent a year or so focussing on reining in spending. Now Luxon is preaching grow, grow, grow. He is even coming out and saying that he thinks the RBNZ should keep dropping rates. Are we going to start to see infrastructure spend – which in turn will provide economic stimulation?

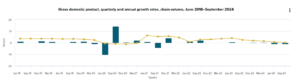

- GDP – and no wonder the focus is on growth. GDP won’t grow if we don’t invest. The trend is not encouraging.

Inflation is under control and the economy is lagging and we have a government that knows it needs to get some runs on the board if it is to get a second term in office. We therefore expect steady stimulation throughout the year.

Set your investment plan accordingly! Happy bouncing.