Humans aren’t Meant for Survival

Survival to Thriving: Riding the Waves of Economic Turbulence

The phrase “survive till 25” has become a rallying cry for those feeling overwhelmed by the state of the economy and the higher interest rate environment. While the sentiment may stem from a place of realism, it’s also deeply flawed. If all we do is focus on mere survival, we risk stagnation—or worse, moving backward. As humans, and especially as financial stewards of our own futures, we are not meant to merely survive. Sure, humans are wired to be able to know how to survive – but that is not our purpose. Are we not most purposeful when we are creating? Are we not meant for thriving?

Thriving requires a mindset shift. It’s about adopting a long-term strategy, one that allows us to ride the waves of economic turbulence rather than flounder in the wash. Let’s explore how we can achieve this, even amidst challenges like high inflation and higher interest rates.

The Problem with Waiting for Calm Waters

High inflation and the subsequent rise in interest rates have made financial headlines for the past couple of years. Many have responded by adopting a “wait and see” approach—holding off on investments, deferring big decisions, and hoping for better conditions. The risk with this approach is clear: by the time the waters appear calm, the opportunities may have already passed. Markets move fast, and those who hesitate often miss the boat.

Instead, we need to look beyond the immediate volatility and take a broader perspective. Thriving in any financial climate means anticipating the waves and positioning ourselves strategically, even if conditions are challenging.

Lessons from the Ocean: Ride the Wave or Roll Over It

On a recent trip to the Gold Coast I watched surfers navigate the ocean. The hardest place to be was where the waves were breaking. I know that from personal experience. 20 years earlier I took a surf lesson on the GC – I was determined to stand up, but got thrown off the board. My face planted into the sand, and I skulked back to my hotel for sympathy. Instead, I was greeted with guffaws from my wife and mother-in-law who nick named me ‘Scabby Doo’ as I’d grazed my nose and face. Real surfers paddle out to where the waves form. From that vantage point, they can make a choice: ride the wave with confidence or roll over it and prepare for the next one.

The same principle applies to financial decision-making. When markets are turbulent, the temptation is to stay in the “breaking zone,” reacting to each wave of news or volatility. But true financial resilience comes from looking ahead. Instead of being overwhelmed by immediate pressures, position yourself where you can see the broader trends and make calculated moves.

Strategies for Thriving in Challenging Times

- Invest with a Long-Term Horizon – Markets rise and fall, but over time, they tend to trend upward. Waiting for the “perfect” time to invest often leads to missed opportunities. Rather, invest in a planned consistent manner, regardless of market conditions. This strategy smooths out the impact of volatility and allows you to benefit from compounding growth.

- Adapt to High Interest Rates – While high interest rates can increase borrowing costs, they also create opportunities. At Erskine Owen we have been able to take advantage of such opportunities over the last couple of years…for the benefit of our investors.

- Property Investment – Property remains a stable long-term investment when done well. While the current economic conditions might seem daunting, taking a strategic approach to property can yield substantial returns over time. Use the holiday season to step back and reflect on your goals. What does your 10-year plan look like? Setting clear objectives now can help you capitalize on opportunities in the future.

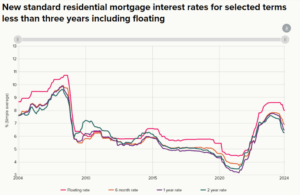

- Trust the Cycles – Sitting out in the surf you know that after a few mediocre sized waves a bigger one will come rolling through. So, you are ready for it. And then, you swim like crazy and body surf to the beach showing your three teenage kids how it’s done. OK, so there may be some hyperbole there. All year, we forecast that interest rates would come down this year. Why? Because it’s like surfing – the rhythm of cycles pointed to interest rates dropping. And what happens when rates drop? It frees up capital, it becomes easier to get debt, demand for property lifts and….prices go up.

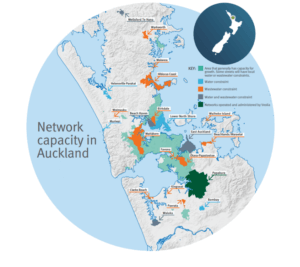

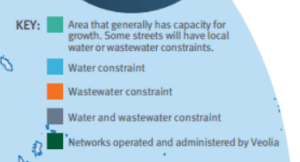

- Trust the Fundamentals – Chris Bishop, Housing Minister, made announcements this year about forcing councils to open up land supply. Great! However, we pointed out in our War on Inflation is Won article that it is easier said than done. A recent example shows just how true this is. Having denied that we have a problem, Auckland Council’s water company (WaterCare) has finally come out with a heat map revealing that key areas in Auckland have water infrastructure problems that are preventing construction, even though developers may have a resource consent. Thus, emphasising the fundamental: demand (once released from the constraints of hard–to–get finance) eclipses supply. If we truly believed this, we’d be buying property like there was no tomorrow.

- Act – One of the biggest mistakes we see is people analysing, discussing, sleeping on, property investment scenarios and then doing nothing. It is very easy to justify taking no action – in fact, sitting on the sidelines can be made out to be very wise and valiant. Oh, but what about Warren Buffett – isn’t he cashed up? The only reason he frees up a bit of cash is so he can aggressively pounce on opportunities. He has a history of acting.

- Collaborate – Norman Vincent-Peale wrote the old classic ‘The Power of Positive Thinking.’ He asserts that the most successful people are those that collaborate creatively. Some get stuck thinking they have to do it all themselves. That is why we coordinate property syndications/ funds…it’s simply a way to allow people to collaborate and buy property they wouldn’t be able to otherwise buy themselves.

Thriving Despite Challenges

Economic turbulence is a fact of life. High inflation, rising interest rates, and other challenges will come and go, but waiting for “perfect” conditions isn’t a viable strategy. Instead, focus on thriving despite the circumstances.

When we shift our mindset from survival to thriving, we embrace a proactive approach to managing our finances. Like surfers scanning the horizon, we learn to ride the waves or roll over them, always looking for the next opportunity. By adopting this mindset, we position ourselves not just to weather economic storms but to emerge stronger, more confident, and ready for the future.

Remember, at ErskineOwen.co.nz, we can help you with financial planning and property investment strategies. Why not take advantage of this season to start shaping your thriving future?

This summer get in the surf, paddle out past the wash, look way out to where the waves start forming – spot a big wave, anticipate, paddle – have a great ride. We look forward to seeing you in 25 – we’d love to help you catch some great property investment waves, to…thrive in 25.