Like Possums in Headlights

We’ve had a bit to say about inflation and interest rates over the past year or so. This is a hot topic and has had a massive impact on many Kiwis. It’s not just those with mortgages, but also the businesses and retailers who bear the brunt of consumers spending less.

Our motivation for tracking this along the way has been to provide evidence that the war on inflation was won a long time ago and therefore interest rates would start coming down…so that investors would feel confident to get on and invest, or not sell out of panic. Our hope is that people wouldn’t be stuck like a possum in headlights with the fear of what is happening. This is part of a cycle, the world is not ending, markets will recover, and property prices will go up again. As predicted, inflation and interest rates have started dropping globally and we are starting to see the evidence of the beginning of a new property cycle.

Hasta La Vista, Sayonara, Adieu…to high interest rates

Before we address the early signs of the property market turning, it is worth reiterating that interest rates in NZ are on the decline and highly unlikely to start rising again anytime soon. The one-year swap rate which is the base rate that banks use to add other costs and margins to arrive at their 1-year fixed mortgage rate, has fallen from the high 5%’s at the start of the year, to 4.06% at the time of writing. Notably, the rate has dropped weekly over the past 3 weeks and has fallen at the fastest rate since the retreat of the GFC in 2008. We are expecting cuts to the OCR on October 9 and again on November 27. Why is this important? Because interest rates track closely with the direction of swap rates.

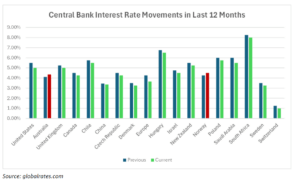

The graph below shows that central banks in all but two of the 18 countries have dropped rates in the last 12 months. The two that increased rates, Australia and Norway did it late last year. Australia has rising house prices it is trying to fight due to undersupply of housing, and Norway has signalled it will start easing rates early next year on the back of inflation trending downwards since April. In big inflation news globally, the US Federal Reserve issued a supersized cut to the Fed funds target rate two weeks ago. They went 50 bps (½ percent) to reverse one of the most aggressive interest rate programs in decades.

The global trend is on the way down and that signals good news for the cost of imported goods into the country. Vehicles, pharmaceuticals, electronics…watch this space.

The Worm is Turning

For those possums that didn’t get caught in the headlights and have started investing again. They are getting in just in time.

How do we know? The REINZ nationwide house price index (HPI) monthly decline has stopped. It was unchanged for August, after falling .3% in July, .6% in June, and .9% in May. (The HPI is a more reliable measure of sale price data than median house price, by stripping out anomalies and normalising data)

If we delve in to the regional stats, we can see that things are on the improve in some areas, but not in others. While we may be at a turning point in the house price cycle, not all regions will turn at the same time. When an upcycle begins, demand and supply rise at the same time. Nationally, inventory of housing stock is up near on 30%. This will vary across the regions and the respective supply and demand pictures will govern how quickly sale prices increase. Dwelling consent numbers are much higher this time round to that of the last upcycle post GFC, and net migration flows have ebbed away over the last 12 months. Net migration, while a key factor in housing demand and price growth, it is difficult to forecast, so we will keep watching closely.

This is no doubt, a very interesting time as we track towards the end of the year. While there are still challenges in our economic outlook, the direction on inflation and interest rates is clear. Interest rate certainty has signalled a huge positive shift for investors.

We are encouraged that many of our clients are making the decision to get on and invest before the property market begins its ‘uptick’ in earnest, and we are encouraged that many who were planning to sell have ‘stayed the course’ and can now look forward to some lower interest rates. What about those of you sitting on the sidelines – will you miss out on some of the opportunities this part of the property cycle brings? Are you procrastinating, fearful of committing to your wealth creation journey?

Much opportunity awaits discerning buyers who set out to invest intelligently.