Goodbye 8% – It was the Best of Times; it was the Worst of Times

Has 8% been your friend or foe? At Erskine Owen we see both sides of the 8% coin. For people with property debt, mortgage rates of 8% +, it has been painful. The rate at which interest rates rose meant the impact was felt quickly and it was hard to make changes rapidly enough to fight the rises. On the other hand, for those with cash it has been possible to achieve much higher rates of return. So…good for those looking for an investment deal, not so good for those with property debt. However, with the RBNZ announcement that the OCR is now dropping the tables may be about to turn. The question is how low and how fast will rates drop…and therefore what should we be doing?

Ramble or Race?

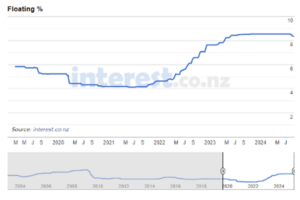

The OCR punched through the 5% barrier in April last year where it has remained. Consequently, the floating rate has sat above 8% for the same time period. To understand how fast and far the OCR will come back down it helps to look at what drives the OCR up, and down.

To my thinking there are 4 main reasons for lifting the OCR and a couple to push it down.

- To fight inflation – too much inflation is deemed bad for an economy.

- To combat asset (house) prices getting too heated…the definition of which can vary depending on which measure the RBNZ Governor is using.

- Prevent an economy overheating – which can include rapidly rising asset prices but will include other measures.

- To strengthen a currency – higher interest can attract offshore investment and thus increase demand for the currency

Possible reasons for decreasing the OCR are:

- To stimulate economic growth – cheaper money will stimulate investment

- To fight deflation – not that common in NZ these days

So, we can say that for the OCR to come down we need

- The RBNZ to be happy inflation is under control,

- House prices that are not rocketing up,

- Poor economic performance.

We think a tick on all three accounts:

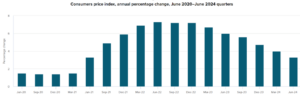

- If you have been reading our commentaries, you’ll know we have argued that inflation was back under control months ago if you measured it on a quarter-on-quarter basis as opposed to the year-on-year basis the Department of Statistics uses. That said – CPI to June was 3.3% – next announcement October. We expect this to be under 3% because there are redundancies, businesses are failing, and people are tightening their belts. A friend with a high-end jewellery store says it has been his worst year since he started two decades ago – so worse than the GFC. Plus – it’s as much about the trend as it is about the latest result – look at the downward CPI trend in the graph below. There simply aren’t any economic drivers at play at the moment to drive inflation up.

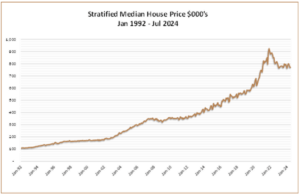

- House prices at the moment are not going up. We have started to see signs of life – multi offers are back – but the evidence of price rises won’t show up in stats for months. So definitely no ammunition for lifting the OCR in house prices.

- Economic performance – the necessary driver for dropping the OCR. Moderate inflation and house price growth will stop the OCR going up – but it is a weak economy that needs stimulation that will see the OCR drop. GDP for the March quarter saw NZ sneak out of recession with growth of 0.2%. Hardly a convincing result. What will the June quarter be? We wouldn’t be surprised if we dipped or sank back into a technical recession – here’s why:

- The government is contracting spending

- KO is not currently building houses

- We are getting regular news of collapsed business

- Unemployment is on the rise see graph below. And it’s very obvious with all the regular, large redundancies

- The big 4 accounting firms have laid off staff in their consulting divisions – 50 to 100 each

- One NZ asking for voluntary redundancies

- Spark subsidiary making 100 people redundant

- And what about the electricity crisis. Talk about 3rd world. Successive governments have not invested in infrastructure like they should’ve…NZ is slipping behind the rest of the world on this front. We need a government to be brave enough to ‘build stuff.’ Easier said than done, I am sure. Anyway – the point is that it is creating business contractions and in some case closures.

- Productivity dropped 0.9% – the largest fall since 2009. It means we are producing less per hour of labour. That probably means that we are doing less value-add work. No surprise given how many professionals are high tailing it for Aussie and beyond.

- Construction has had no reason to tool back up.

The impact of all of this will take time to filter through to the stats. As people lose jobs they cut their cloth accordingly. That means further reduced spending, which means further downturn in sales, which means less investment.

So…while not trying to scaremonger, I think the above means we could be in recession for a couple of quarters at least. A lot of the above are structural issues. You tell a major firm to pull back production because they can’t get enough electricity – how motivated are they to continue operating? Even if supply frees up – will they want to ramp back up? And it’s not easy to get the professionals who have gapped it to get back here if they are sunning it on Bondi with a higher salary. One of our three children is in Sydney studying – how motivated will he be to come back here?

So, to the race or ramble question. To summarise:

- There is absolutely no reason to lift the OCR

- The potential (likely?) woeful economic performance data to come will provide strong reason to get the OCR down to a point it quickly stimulates economic activity

- The government is sucking money out of the economy

- We have a RBNZ Governor who tends to respond very assertively to data. HE cut the OCR hard during covid and he hasn’t been afraid to hike it during this high inflationary period. Now he has the unemployment he has been angling for he will be happy his job is done

- Further rate cuts have already been signalled

- If we look at the OCR back to 1986, we can see that OCR rate rises tend to be more gradual, whereas OCR cuts tend to be more aggressive. Makes sense doesn’t it – economies tend to heat up more gradually and the OCR responds accordingly. But on the other side – we often get an economic crisis – 80’s crash, GFC…and possibly now the Post Covid Crunch – PCC (you heard it here first). And in response the OCR needs to come down quickly to kick start the economy.

And therefore, we think there is ample reason to suggest the OCR will come down quickly with decent downward steps. We tabled some time ago that the OCR could be back down before Christmas 24 on the basis that worsening economic conditions would necessitate it. So, when thinking about the OCR in the near future – It is the current economic conditions that have to be taken into account – the not yet reported data. Again – let’s just stop and think of the flow on effect of the current electricity crisis and recent business failures and redundancies…that have not yet had time to show up in statistics. How could we see GDP growth with these events?

Now What

For the cashed-up investor, you’ve enjoyed the higher term deposit/bank bond rates. Think carefully now about money coming off fixed term. If you fix it for another 6 months – rates could be a lot lower at the end. You may have been happy to accept the erosion of your wealth (inflation impact) leaving your money as cash at bank given your nervousness about the impact of higher interest rates on the economy/ other investment formats. However, why would you not take advantage of 8% opportunities while you can – they won’t last. For example – we have a few units left in our Countdown Syndicate in Canterbury. We picked this property up with a 9% cap rate. The vendor had paid about 6.5% for it. As interest rates drop – the value of this property will rise. It will also mean that over time we can increase distributions.

For the property investor, pain relief is on the way. A 25 basis point drop won’t help that much – but 200 basis points (2%) will. Surely the OCR will be at 3.5% or less by March next year? IF that is the case, then the time to start investing again is now before the market takes off. And it will take off. In our board room briefing we talked through our rationale for why the property prices simply have to go up. Ask us for the presentation.

Conclusion

Having possibly given you the chills about where NZ is at, I want to give you a quote from Charles Dickens Tale of Two Cities

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

While the economic picture is not great at the moment, we have a government very focussed on getting crown debt back under control, reigning in government spending and attracting more overseas investment – amongst other things. Labour governments often tend to go on spending sprees and National led goverments tend to reign things in. The fruit of National’s work won’t be seen for some months to come; however, it should pay dividends. Also – NZ remains an attractive country to the northern hemisphere wealthy to have at least a bolt hold. And – Kiwis are a resourceful, resilient bunch.

Here’s to a healthy, thriving NZ economy and society.