The War on Inflation is Won, Prepare to Occupy

You know that feeling – when you’ve been in a hard battle, the fight is still going on, but you basically know you’ve beaten your foe. I’ve had the experience several times over the last few days as I lived vicariously through Olympic athletes.

In the rowing, the men’s pair had a stunning race and came second in their heat in order to qualify for the next round. In the last couple of seconds, you knew they would come first or second. Or Clareburt in the 400m IM in the pool. In his heat I was screaming at him to wind up, and he did…I knew he’d get there. Yes, I am one of those individuals that loves the Olympics. No, I don’t pretend I had untapped potential and could’ve podiumed in any sport I put my mind to. But I do love the emotion of it.

The War is Won

Our Olympics is prevailing over interest rates. When I say ‘our’, I mean all of us who have to battle high interest rates on our property debt. It is a 15 round boxing match. However, it certainly feels like the fight is won. For the past several market commentaries we have been closely following inflation and interest rates. I have commented extensively since Christmas 2022 that the back of inflation was broken, the job was done, and it was a matter of letting things work their course. More recently I have highlighted that inflation in NZ is measured year on year on a rolling basis and it shows inflation continuing to track above 3%. However, month on month that is not the case – we are back under 3%. And therefore, I have argued that we can now afford to start dropping the OCR.

Major banks who were until recently forecasting OCR rate drops in 2025 are starting to suggest pre-Christmas this year. No surprises. Consumers have had to massively tighten their belts for a long time – it’s just that you don’t immediately see that because other factors have influenced headline inflation data to make it read well north of 3%. However, that decreasing consumer spend has steadily taken its toll on the revenues and thus profits of many businesses. Now some are asking – has Orr gone too far? Is he forcing businesses to cut capacity; people; warehouse space; machinery…? Coming back from that takes a lot more time than simply recovering from having to take on a bit more capital to cashflow the rough patch.

Of course, those are just the conversations I am having, and it is not particularly scientific. However, I come back to my Olympic analogy. I think we all know it’s over – it’s just whether the RBNZ will reduce this side of Christmas or in the New Year.

Therefore, this is old news. The War is Won. We are now starting to think of what will happen once interest rates start dropping.

Prepare to Occupy

Suppose I am right. If you are holding a bit of debt and it has been eating into your cashflow you might be preparing to breathe a sigh of relief. After that – let’s think about what will happen:

1. Sentiment will lift

Just one OCR drop of 25 basis points is likely to put the spring in the step of many home buyers and investors who have been waiting on the sidelines for exactly this moment. These are the people who are too afraid to buy while interest rates are rising because they have zero confidence to act until they have Orr ‘telling’ them that the days of rising interest rates are over. If that is you – don’t worry, it’s most people. Keep in mind it’s not the drop itself, it’s the message it sends about the next 36 months. People will assume that we’ve hit the top and we’ll be on a steady drop in rates.

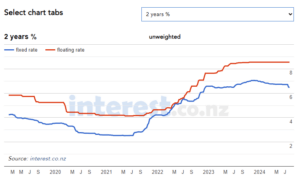

2. Interest rates will drop

Actually, they already have been. Check out the 2-year graph below (average of all 10 banks). They peaked in November 23 and already they have dropped 50 basis points and are back to 6.5%. This is because the cost of money for banks has been getting cheaper. And.. all the banks know rate drops are coming.

Whenever a bank proactively rings me to help me fix my rate, I know we are in the next part of the cycle.

- Bank: Dear Alan, could we help you fix at 6.5%

- Me: Why would I do that when the 2-year rate is likely to be significantly lower in 3 months?

- Bank: I am just part of the customer service team offering superior service

- Me: Where were you when rates were going up – you didn’t ring me to encourage me to book in a rate before they went higher.

Please don’t construe that as cynicism…I am trying to give up. I am really just trying to highlight where we are at.

3. Demand will Lift

Those who have had a sentiment change will create demand. Not all of them will buy because some people will then second guess and think they should wait till they see prices starting to rise. But some will.

Additionally, the people that have been wanting to buy all along will finally start to be able to. A falling OCR will give the banks confidence to drop the test or hurdle rate they use in assessing serviceability.

4. Supply will Struggle to Keep up

As demand lifts developers will start to liven up their hibernated projects. However, keep in mind that a lot of developers have struggled to get finance for their projects because they have needed a lot more presales compared to when the market was more buoyant. So, they will need to ramp up the marketing, engage sales agents and get ink on sale and purchase agreements. Only then will we see an increased flow of supply.

Meanwhile demand continues to build as rates keep dropping. And so, the cycle begins again. “Wait – don’t forget about National’s new housing policy that will massively lift supply!”. Will it? Will the policy/plans have the desired effect? Let’s look at the policy statement. Before we do that let me make it clear that we at Erskine Owen really want to see NZ’s housing challenge fixed. Good housing is fundamental to healthy communities and a thriving economy. Things need to change, and we believe housing should not be a political football. Like a lot of things, however, the devil is in the detail.

The National Housing Policy and our comments policy (source):

What thinking about the detail says to us is that:

- We need solutions. We need to be unlocking land

- There is some promise in these policies…we think there are some good ideas

- However, to implement them is not quick or easy. This will take time and cooperation from both sides of the political spectrum.

Therefore, we think it is very safe to conclude that we are not going to see a flood of supply. In the meantime, the population will continue to grow. And therefore, the demand/ supply imbalance will continue for some years. And therefore, as interest rates drops, we are confident we will see prices rise…as they have done for decades.

So, to conclude, the war on interest rates is won…there is still a skirmish going on, but we know the outcome. Prepare to occupy – well its great there is a policy in place to open up more houses for the nation to live in…it’s just that preparations may take a while.