Director’s thoughtpiece: Dying is Easy – Living is Harder

That’s a line from the musical Hamilton which I recently saw…an amazing show. Alexander Hamilton was a founding father of the US – his early life was hard, he fought in wars against the British, he worked incredibly hard for President George Washington, and then he died in a duel defending his honour. Reading his biography, his life was about bettering himself after his father left, and then his mother’s death while he was a boy. There was nothing easy about his life.

Hamilton achieved a lot – he was one of the key players in the establishment of a central banking system in the US. I’d argue his was a life worth living. Our central bank has contributed, rightly or wrongly, to making living more costly in NZ. Do we give up and let our investment dreams die, do we disengage while there is interest rate uncertainty, do we shutter the family coffers in the name of prudency without questioning if we have in reality given fear a name it doesn’t deserve?

I’d argue that amidst these challenging economic times, it is worth pursuing life…but no one says it will be easy. I hope these observations may give motivation to pursue ‘life’ in your investments.

Summary of why we should feel good about Investing

- The OCR has likely peaked given signals from the RBNZ. They believe they can pull back on OCR rates rises because:

- Inflation is slowing

- Freight costs and capacity constraints are easing

- Though the budget had some increased spend, the RBNZ sees it as unlikely to have a major impact on inflation

- US banking failures have been ‘managed’ by the US govt

- Net migration, while markedly up, is not expected to be a massive driver of inflation

- Consumer spending has pegged back

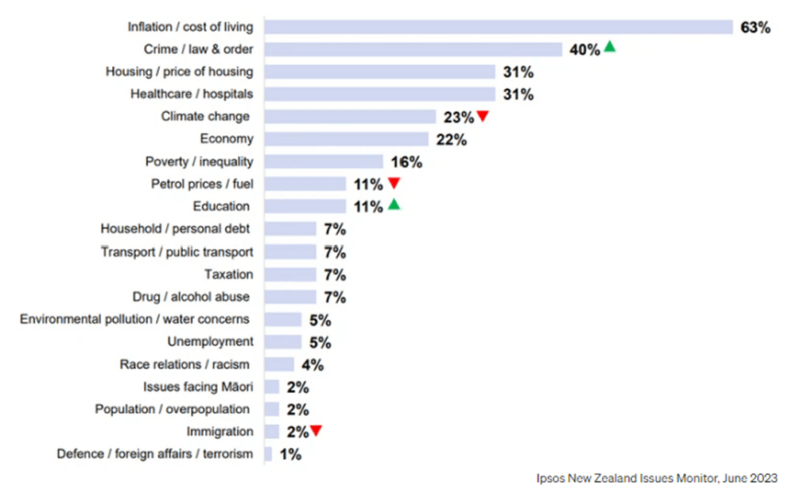

- Accountability – yes we do have a democracy. Labour have enjoyed years of popularity that have allowed them to ‘spend’. Those days have come to an end given cost of living is the publics’s number one concern and because we have an election looming.

- Storms – we hope we are done with them for another 100 years, but regardless, the financial impact is probably already factored in.

- Expectations are firming that interest rates will drop next year, as evidenced by 3 year mortgage rates and market pricing

- LVR restrictions have eased for investors with minimum deposit reducing from 40% to 35% for investors.

OCR Peak Reached?

Adrian Orr’s comments at last month’s OCR announcement indicate there are unlikely to be any more OCR rate rises, and therefore 5.5% is as high as the OCR will go. Here is our summary of RBNZ’s Monetary Policy Statement that supported their final (we hope) rise of 25 basis points:

- Slowing inflation – the slowing of inflation surely gives RBNZ confidence that the beast has been slain and any further inflation outside acceptable bounds is simply death throes. We signalled our opinion in Dec 22 that the back of inflation had been broken and it would just take time to work through. We are now seeing the impact of homeowners rolling off fixed-rate periods onto higher interest rates and having to reduce the spend…shorter showers anyone?

- Government spend I am sure Mr Orr would not have been thrilled to see unexpected spend in the Government’s budget, but probably not surprised. He knows a Labour government is more inclined to spend. He endeavoured to downplay the possible inflation fuelling impact by saying the spend was a lot less than spend in recent history. Our teenager deploys that rationality when trying to justify an afternoon sifting on the couch not studying by saying it was better than the day before…that wouldn’t be hard given he slept the whole previous day.

- Freight. The cost to import a container has tumbled from giddy heights back to pre- Covid levels. The signs of this happening began 6 months ago. More than that, some shipping companies are now offering heavily discounted rates on some legs just to move empties…that’s because there isn’t the same amount of ‘return’ freight on some legs. A friend who is CEO of a larger electronics firm in NZ has just wiped 600k off his local freight bill (port to warehouse). He put the business out to tender and was pleased to see the fuel surcharge, the congestion charge, and whatever other charges that were added during Covid had magically disappeared. Why? Firms such as this need to clear the stock buffers they built up during Covid, which means they aren’t ordering as much from the mother ship. There isn’t the same volume of goods being shipped.

- Net migration was a whopping 65,400 for the year to March 2023. In Hamilton the line ‘Immigrants, we get the job done’ evoked a roar from the crowd. Perhaps there were a lot of orchardists up from the Hawkes Bay who are relieved they can finally access the labour they need. On the one hand, this helps to ease the tight labour supply and thus ease wage inflation, on the other hand more people means more demand for consumer goods. Regardless, the RBNZ did not consider it a big enough concern to think it might require further OCR hikes.

- Tourism Tourists are returning to NZ and bring with them tourism spend. Inflationary? I suppose so, though I’d argue that there is an offset of Kiwis finding their wings and taking the dollars they were spending on renovation and whitewater offshore. I’m not sure I’d be concerned about this. Tourism is a big part of the NZ economy and overall I’d suggest it’s a good thing. More to the point – the RBNZ did not see it as red flag.

- US banking system. RBNZ needed to mention the collapse of a couple of US banks, and duly dismissed it as an imminent threat to the NZ economy since the US government had essentially stepped in and provided comfort they’d provide a backstop. A ‘nothing to see here’ message. We’d agree – if the US government stepped in during the GFC to rescue Freddie Mac et al, then of course they are going to smooth over a couple of relatively immaterial bank failures.

- Consumer spending. New Zealander’s seem to have embraced the need to tighten the belt, partly because they simply have to, partly because we are probably accepting we need to do our part to tame inflation. This is a happy sad face. Happy because belt tightening will help curb inflation. Sad, because I don’t like the RNBZ ‘berating’ perceived consumer overspend and ministerial lectures about short showers when the growth in inflation is driven by a number of factors…government overspend and RBNZ policy arguably amongst them. Regardless, consumer spending has contracted and that makes Mr Orr feel happy.

Accountability

A friend of mine tells a story of many years ago hitting a teacher and getting away with it when he was in his final year of school. How? The teacher was tapping the boy’s nose saying ‘you will be a failure’. As soon as he hit him, he said to the teacher ‘I’ll see you in the headmaster’s office’, walked across the school, told the headmaster what he did, said he knew it was wrong and apologised. The headmaster checked with the teacher if the story was accurate, then told my friend he was free to go. That’s called accountability, or justice…or something.

NZ’s democratic system might be frustrating – but at least we have one…there is a form of accountability:

- At the May OCR announcement, a journalist asked Adrian Orr if he was accessible and accountable enough. Orr got defensive and said he felt ‘very personally attacked’ by the journalist. Probably not the response a PR agent would have counselled…but Adrian if it’s any consolation, that is often my response when I get asked the same question around home. The point being that the video is still on the RBNZ website for all to see – a form of accountability. If you want to listen click here – minute 28:03. Well done Jenna Lynch of Newshub.

- I am sure there will be more election bribes, however, I think the government knows that what will have more of an impact is if inflation keeps slowing and interest rates stop rising (or even fall?) and that it assuages the biggest concern the voting public have – the cost of living…as shown in the survey results below. The looming election is likely to keep a tight rein on any government overspend in coming months.

Labour has had run of popularity that allowed it to do things it probably couldn’t if the polls had been tighter. That season appears to be coming to an end.

I see skies of Blue

We’ve had our ‘one in a hundred year’ storms and we can now plan the next 100 years. OK, so maybe 100 years has become a little more frequent. The aftermath will take some time to work its way through. However, it’s probably fair to say the majority of rebuild spend has now been factored in. Nothing to see here.

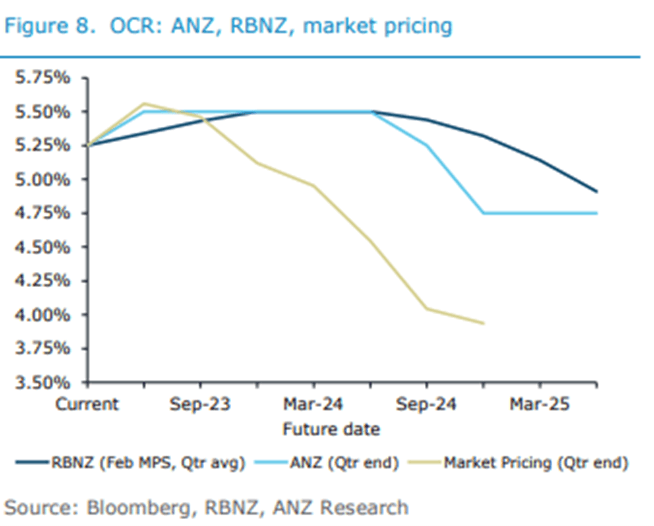

Expectations

The market is expecting rates to start coming down. The 3 year rate is now at 5.99% (as of 13 June) with several banks – it was 70 basis points higher in January. The market is also expecting rates to drop over next year -see the ANZ graph below:

LVR Restrictions Easing

The RBNZ decided house prices were at a level they were comfortable with and therefore reduced the minimum deposit for investors in housing from 40% to 35%. Click here for the detail. Additionally, banks can now make more than 80% + mortgages to homeowners – lifting from 10% to 15%.

House Prices Bottoming Out?

Plenty of anecdotal evidence that we may have reached the bottom – sales agents are noting a lift of open home attendance; our buyer agency business has experienced a considerable lift in inquiry and engagement; our mortgage business has experienced more applications along with banks becoming ‘easier’ to work with.

What is also likely to contribute is simple demand-supply factors:

- Net migration significantly up – 65,000 more people need a home to live in.

- Easing of LVR restrictions means we need to find less equity for the next property – so easier to buy.

- Cheaper interest rates at the 3-year level.

- Confidence – some may start banking on a National/ Act coalition will be the next government, and that they’ll roll back non-deducibility of interest.

- And don’t forget supply – builders have struggled to sell anything off the plans in the last 12 months and that means we are not building the houses our growing population needs.

To Conclude

If interest rates have peaked, the housing market has bottomed out, LCR restrictions have eased, and expectations of interest rates dropping have increased, then I’d suggest more than a few people will be feeling more positive and be looking to invest. That would signal the start of a new cycle.

Being indecisive is easy, living the life of a decisive active investor is harder.