Why mortgage interest rates might not track directly with the OCR

Have you noticed how people have stopped talking about house prices and started talking about interest rates? That’s hardly surprising given the high percentage of Kiwis paying interest on a mortgage or loan of some description. The value of our houses increasing makes us feel wealthier but doesn’t have any direct impact on our cashflow. However rising interest rates hit us directly in the pocket and some kiwis are starting to feel the pain.

We’ve been fortunate in recent times – floating mortgage rates have been under 7% since January 2009 and interest rates have tracked steadily down till they bottomed out in the middle of 2021. But many see the sudden surge in the Official Cash Rate (OCR) as alarming and worry that the end game is a return to mortgage interest rates of 7%+. Its difficult to make rational financial decisions based on the interest rate opinions of your Uber driver, the guy on the train, or your mates at a dinner party.

So what are the experts saying?

We fund a lot of our commercial property syndications through the ASB and follow their commentary, along with others, closely. The ASB’s current forecasts (per weekly commentary dated 30/05/2022) show the OCR getting to 3.50% by December 2022 and remaining at that level through 2024. As a comparison, the RBNZ May 2022 Monetary Policy Statement (MPS) has the OCR averaging 2.9% in 2022, and 3.9% in 2024.

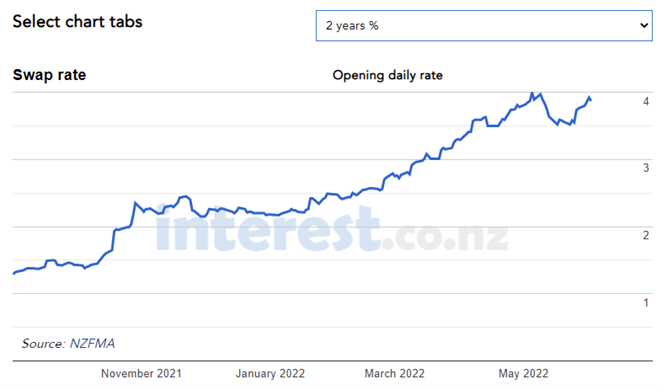

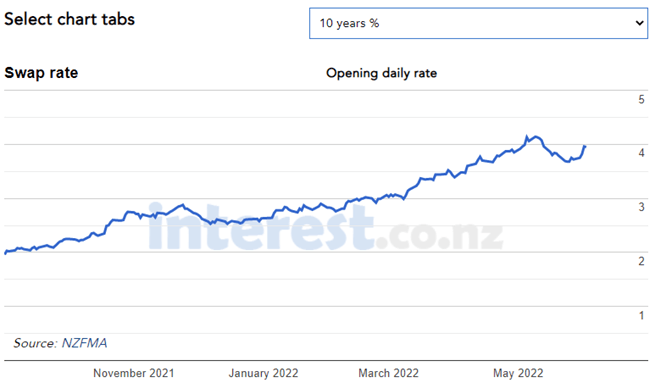

The current OCR is 2.0%. So the expected increases in the OCR are significant. But what will be the impact on mortgage rates? Will they increase up to 2% from the current levels (end May 2022) of 4.5%-5% (1 year fixed) to 6.0%-6.5% (5-year fixed)? The most likely answer is “No” – the rates currently being offered are already pricing in expected increases in interest rates over the fixed period. And a quick look at the market pricing of interest rate swaps shows us that the market is pricing a 2-year swap at very similar rates to a 10-year swap at just under 4% (Note: these are inter-bank lending rates – your mortgage or commercial lending rates will have the bank margin on top!)

The market pricing is consistent with the sentiments outlined in economic commentary and the RBNZ May 2022 MPS. Most market commentators appear to be of the view that economic headwinds, together with the impacts of tightened monetary policy will mean that the RBNZ won’t have to take the OCR to 4% to achieve their mandated goals and objectives. The RBNZ’s May 2022 announcement acknowledged this by stating: “Once aggregate supply and demand are more in balance, the OCR can then return to a lower, more neutral, level.” In their August 2021 MPS the RBNZ estimated the neutral OCR to be 2.0%.

The primary factor currently driving increased interest rates is high inflation. The March 2022 Quarter CPI figure was 6.9% – well outside the RBNZ’s band of 1-3%. The RBNZ tightened monetary policy by increasing the OCR by 50bps in April 2022, and another 50bps in May 2022, which was a strong signal to the market that they intend to take decisive action to curb inflation. Based on the ASB and RBNZ forecasts discussed earlier, we will see further tightening over the next 6-12 months with the OCR rising another 150-200 bps. The RBNZ believes this action will be sufficient to curb inflation and are forecasting the CPI reducing to 4.4% by March 2023 and 2.5% (or inside the required band) by March 2024. If that forecasting is accurate, we could see a return to neutral interest rate conditions in 2-3 years.

What are the factors that will impact the trajectory of interest rates over that 2-3 year period? The RBNZ identifies the following key issues:

- Slowing global economic activity.

- The impacts of the Covid-19 pandemic on supply chains and demand.

- Global inflation pressures and tightened monetary policy in other countries.

- The war in the Ukraine causing further disruption to supply chains and prices.

- The response by households globally to increased costs for goods and services.

- Falling NZ house values reducing kiwis’ willingness to spend.

- A shortage of labour in NZ, the level of wage increases, and flow through to inflation.

Many of these issues are beyond our control. NZ is a small country bobbing along in the global financial markets. However, our responses to increases in interest rates and falling house prices will be an important factor – consumer confidence is at all-time lows (ANZ-Roy Morgan NZ Consumer Confidence May 2022) and business confidence is also on the wane. That would tend to support a view that households and businesses will modify their spending behaviour, which will reduce inflationary pressures, and result in current forecasts for the OCR and interest rates being accurate. And the market’s current pricing for interest rate swaps indicates they see this scenario as most likely.

However, there are some commentators who feel that the RBNZ hasn’t increased the OCR early enough, or high enough, to adequately constrain inflation. Unemployment is very low and there is a shortage of labour – this is likely to flow through to wage inflation which in, in turn, may flow through to the price for goods and services. This could mean the CPI remains higher for longer than the RBNZ expects, and they may need to raise the OCR even further to curb that unexpected inflation. Ongoing, and protracted, disruptions to supply chains from the war in Ukraine, and ongoing pandemic impacts (particularly in China) could exacerbate those issues and add fuel to the inflation fire.

How should you respond to this increasing OCR environment?

Our first message would be “don’t panic!” The world isn’t falling on our heads. Interest rates are still historically low – 5 years ago we wouldn’t have blinked an eye at the current, or the expected, interest rate levels. We’ve been a bit spoiled over the last 2-3 years and got comfortable with really low rates. The reality is those rates aren’t sustainable and we should plan for rates to settle in the 4%-5% range over the long term with temporary peaks and troughs above and below that range.